Manage Financial Crime Risk Through the Power of Collaboration

Scalable communication and data sharing tools to work smarter and solve problems faster.

We offer financial institutions the ability to be:

More effective

Human compliance professionals need tools that allow them to understand their FI’s potential exposure to illicit activity, and there is no better way to do that than through communicating with counterparts. No more trying to figure things out with your own FI’s data and a few Google searches.

More efficient

FIs need to be able to generate sharing requests and professionally process replies quickly.

More innovative

Regulators are urgently calling for new ways to combat financial crime and improve existing processes.

Fail Safe

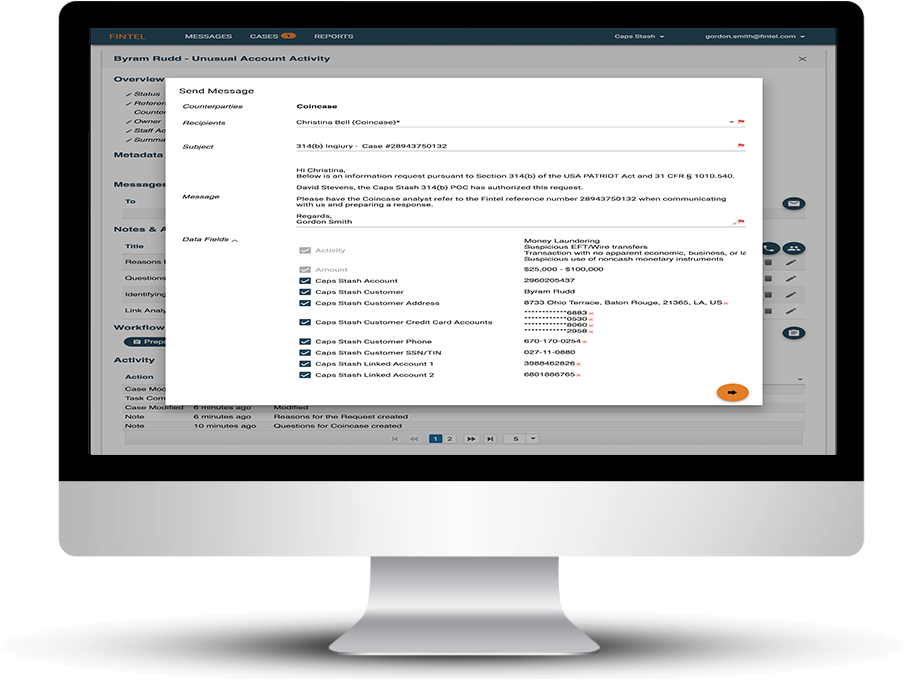

Ensure the critical collaboration process with other institutions for illegal activities is fast, accurate, and fail-safe with features like message tracking, no-response alerts, message routing, and message triage.

Manage Contacts

Manage all correspondent contacts needed for communications with other institutions regarding illegal activities including those from the FinCEN 314(b) list as well as your firm’s other contacts.

Regulatory Compliance

Algorithms assist you in determining whether or not the sharing of customer data complies with the appropriate regulations – GLB, BSA, USA PATRIOT Act.

Structured Information

Categorize and analyze cases by subject, content, location, etc. and see real-time industry trends.

Auditability

Case histories can include both Fintel communications as well as emails and phone logs.

Integration

Mature APIs allow for integration into any case management or data analysis system.